My Name is Andreas Himmelreich, I am a full-time quantitative private investor and consultant via Portfolio123.com (You might know me from Trading for a sub 1 Million Account). Here is my profile https://www.linkedin.com/in/dr-andreas-himmelreich/

In this blog I will provide two Strategy Books based on liquid mid and big cap stocks. A Strategy book is a portfolio of several portfolio strategies.

What Is the AI Factor?

“The AI Factor on Portfolio123.com represents an innovative integration of artificial intelligence into quantitative investment strategies without the need to write any code.

By combining AI with fundamental and technical data, the AI Factor bridges the gap between traditional factor-based investing and AI based data analysis.

The AI Factor employs advanced machine learning techniques applied to a vast database of historical financial and market data. It systematically evaluates and scores stocks based on their likelihood of outperforming or underperforming a selected benchmark.

Unlike conventional factors such as value, momentum, or quality, the AI Factor dynamically adapts to changing market conditions and captures nonlinear relationships in the data that traditional methods may overlook.”

The Strategy Books Mid and Big Caps

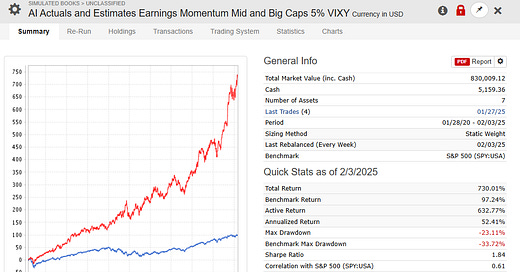

The first strategy book

The above strategy book contains 6 individual strategies on different stock universes (S&P 500, Russel 3000, Non-OTC Stocks etc.). The strategy has a 5% VIXY (long volatility) position for left tail (crash) protection.

The ranking system of all these individual strategies within the strategy book is based on earnings acceleration based on estimates from analysts + from actual data (actual data = alternative data which is collected from press releases).

I took insights (Feature importance from over 25 AI Factor Systems!) from AI Factor Systems to build the above strategy book.

I cannot show a longer backtest, since I have not more data history on some of the specific factors / data used in the strategy.

Right now, the above Strategy book has the following holdings (unhedged version!):

AA 2.34% ALL 1.57% APP 10.96% ARGX 7.10% CCL 3.16% CEG 1.23% COIN 6.20% CVNA 2.97% CYBR 1.79% DAL 1.30% DASH 4.16% DUOL 1.31% EAT 1.44% EQT 1.70% GE 1.88% GS 1.26% GTLB 1.15% HOOD 11.92% JPM 1.87% MS 1.87% MTZ 1.81% RDDT 7.61% SCHW 1.14% TOST 4.08% TWLO 2.87% UBER 4.80% VIXY 4.76% ZETA 2.60% ZIM 1.98%

I will post the (pay walled!) weekly rebalances (in a form of a table!) on Monday morning before the market opens + the history of the live book (for both versions, hedged and unhedged!). The part where you only can follow the cap curves and see how we are doing will be free.

The live book takes all the trades of the individual strategies it contains and it builds an out of sample history, it looks like this (this is only an example and not the history of the strategy books presented in this post!).

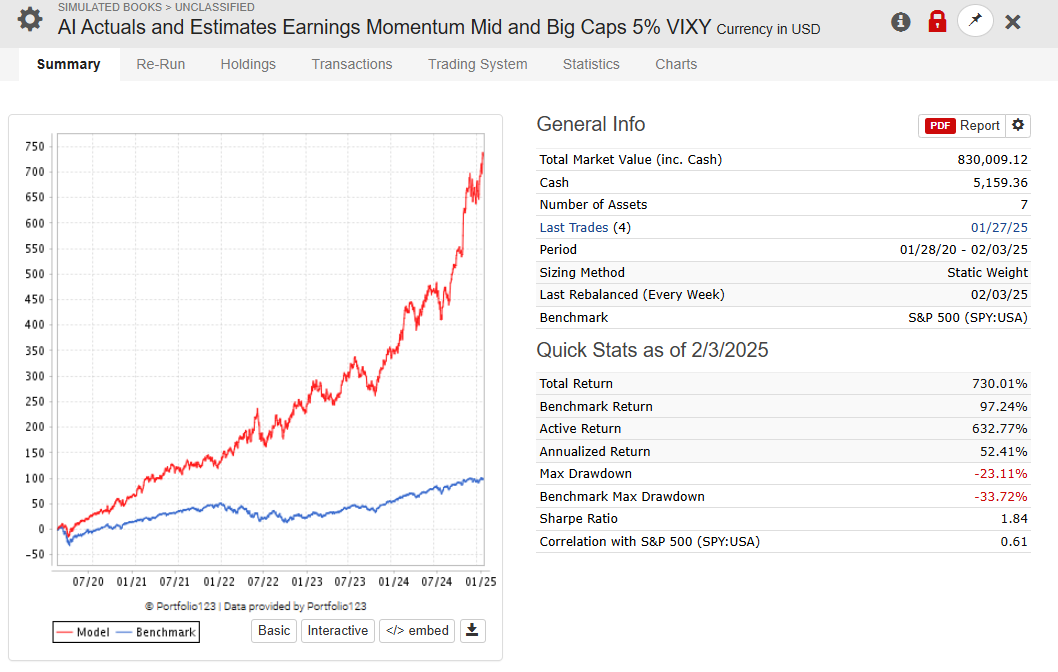

The second strategy book

It consists of 5 AI Strategies, which have up to 365 Features (Factors), the universes span from SP500, Russel 3000 to Non-OTC Stocks. The predictors were trained from 2003 - 2019, what you see is an out of sample test of the predictors of the individual strategies of the book. The strategy has a 9% VIXY (long volatility) position for left tail (crash) protection.

AI Factor introduction (knowledge Base from Portfolio123.com): https://portfolio123.customerly.help/en/ai-factor/what-is-the-ai-factor

I cannot show a longer backtest, (AI OOS Predictor testing has a limit of 5 years).

I will post the results of the validation ML Algo training and testing in another (free) post.

Right now, the above Strategy book has the following holdings (unhedged version!):

ADBE 1.40% CCNE 2.31% CDNS 1.37% CI 1.40% CMCO 3.04% CSCO 1.75% DD 1.35% DGX 2.44% ED 1.64% ENS 2.02% EPAM 2.16% ES 2.32% FTV 1.80% GEN 2.29% HNI 3.80% HOLX 2.30% HURN 1.37% KBDC 2.42% KHC 1.35% LOPE 4.46% MCK 1.56% MDT 3.98% MET 1.33% MTD 2.15% MTX 4.26% NPO 2.50% PSBD 1.78% RRBI 2.30% RS 1.72% SILA 1.73% SJM 4.43% SNPS 3.33% SWKS 1.60% SXT 1.49% SYY 1.23% TDY 1.32% TFX 0.95% VICI 2.21% VIXY 9.09% VRSN 2.33% WAT 1.64% ZBH 2.29%

I will post the (pay walled!) weekly rebalances (in a form of a table!) on Monday morning before the market opens + the history of the live book (for both versions, hedged and unhedged!). The part where you only can follow the cap curves and see how we are doing will be free.

Disclaimer —> Just so you have the background: An internal revenue share between Portfolio123.com and me (e.g., this blog) will be implemented since the strategies are being built and run via Portfolio123.com.

You can find a free base strategy (for P123 Subscribers) books here:

https://www.portfolio123.com/port_summary.jsp?portid=1826066

https://www.portfolio123.com/port_summary.jsp?portid=1825608

https://www.portfolio123.com/port_summary.jsp?portid=1825610

My “small cap designer strategies” stay on P123 (since they are always exclusive to one subscriber): https://www.portfolio123.com/app/r2g (search for judgetrade!).

If you are interested in building your own (AI) strategies via Portfolio123.com please book a Zoom call here —> https://calendly.com/portfolio123meeting.

Risk

Do not get fooled by the capital curves, both strategy books have a high standard deviation (e.g. local volatility is high!), so consider to cost average into the strategy books.

Best Regards

Andreas

P.S.:

Please read the following posts from my other blog to get more background information —>

The information on from Andreas Himmelreich / QuantStrike and this video / blog is for information and discussion purposes only. It does not constitute a recommendation to purchase or sell any financial instruments or other products. Investment decisions should not be made with this video / blog, and one should consider the investment objectives or financial situation of any person or institution.

Investors should obtain advice based on their own individual circumstances from their own tax, financial, legal and other advisers about the risks and merits of any transaction before making an investment decision, and only make such decisions based on the investor’s own objectives, experience, and resources.

The information from Andreas Himmelreich / QuantStrike and this video / blog is based on generally available and paid information and, although obtained from sources believed to be reliable, its accuracy and completeness cannot be assured, and such information may be incomplete or condensed. All performance results are hypothetical and the result of back testing only. Out-of-sample performance may be different. No claim is made about future performance.

Investments in financial instruments or other products carry significant risk, including the possible total loss of the principal amount invested. Andreas Himmelreich / QuantStrike and this video / blog do not purport to identify all the risks or material considerations which may be associated with entering any transaction. Andreas Himmelreich / QuantStrike and this video / blog accepts no liability for any loss (whether direct, indirect or consequential) that may arise from any use of the information contained in or derived from Andreas Himmelreich / QuantStrike and this video / blog.

Is first one based on AI strategies or classic rankings with factors identified via AI? Any screening buy or sell rules?