Public AI Stock Models for Large-Cap Investing: Strategies & Insights

Factor Design, Target Scaling, and Capital Curves — All Open-Source @Portfolio123.com

Factor Design, Target Scaling, and Capital Curves — All Open-Source:

Here are public AI Factor models for large-cap stocks, along with their corresponding portfolio strategies. The AI factor design choices shown below—optimized for mid- to large-cap equities (note: small-cap models require very different configurations)—are built to provide enough stability for you to focus on feature engineering. If you're using algorithms like ExtraTrees, you don’t need to normalize your features, which simplifies development.

You can copy the AI Models like this

Click on —>

The real "juice" lies in how well you've established the foundations of your model design: namely, your scaling approach, your choice of target variable, and whether you normalize the target. Get those right, and you can concentrate on the Features!

For all models below:

Features: 65 features from the Core: Combination ranking system

ML Model: ExtraTrees

Outlier Handling: Z-score clipping at ±5 (applied to both Z-score–based systems)

I) AI Factor Model on S&P500

https://www.portfolio123.com/sv/aiFactor/12260/overview

Scaling: Z-Score

Target: 12-Month Relative Return (12MRel)

Target Normalization: Within-Dataset (historical self-comparison)

This configuration enables the model to identify mean reversion opportunities by comparing each stock to its own historical distribution rather than cross-sectional peers. In practice, the model will ask questions like: “Is NVDA currently cheap relative to its own past?” — producing capital curves that reflect stock-specific valuation reversion patterns.

Portfolio Strategy (Predictor Trained from 2003 -2020):

https://www.portfolio123.com/port_summary.jsp?portid=1855906

II) AI Factor Model on S&P500

https://www.portfolio123.com/sv/aiFactor/12254/overview

Scaling: Z-Score

Target: 12-Month Relative Return (12MRel)

Target Normalization: By Date (cross-sectional ranking)

This setup produces "Mean Reversion / Trend" capital curves by ranking each stock relative to the broader universe on a given date — for example: “How does NVDA rank compared to the rest of the market today?”

Because outliers are clipped (both left and right tails of the distribution are capped = Outlier Limit = 5 = Data 5 standard deviations from mean gets clipped), the system becomes less trend-chasing than a pure ranking approach. This trade-off offers more stability and softens extreme signals, making it suitable for blending mean reversion and trend-following dynamics.

Portfolio Strategy (Predictor Trained from 2003 -2020):

https://www.portfolio123.com/port_summary.jsp?portid=1855902

III) AI Factor Model on S&P500

https://www.portfolio123.com/sv/aiFactor/12252/overview

Scaling: Rank

Target: 6-Month Relative Return (6MRel)

(Also test 12MRel — it may outperform!)

Target Normalization: By Date (cross-sectional)

This configuration will produce "Trending" capital curves, as it purely ranks stocks within the universe on each date. By avoiding outlier clipping, it fully captures the extremes (right and left tails) of the return distribution — ideal for trend-following strategies.

Because no data is trimmed (unlike Z-score systems), this setup embraces momentum-style signals and allows the model to exploit strongly trending behavior in both directions.

Portfolio Strategy (Predictor Trained from 2003 -2020):

https://www.portfolio123.com/port_summary.jsp?portid=1855857

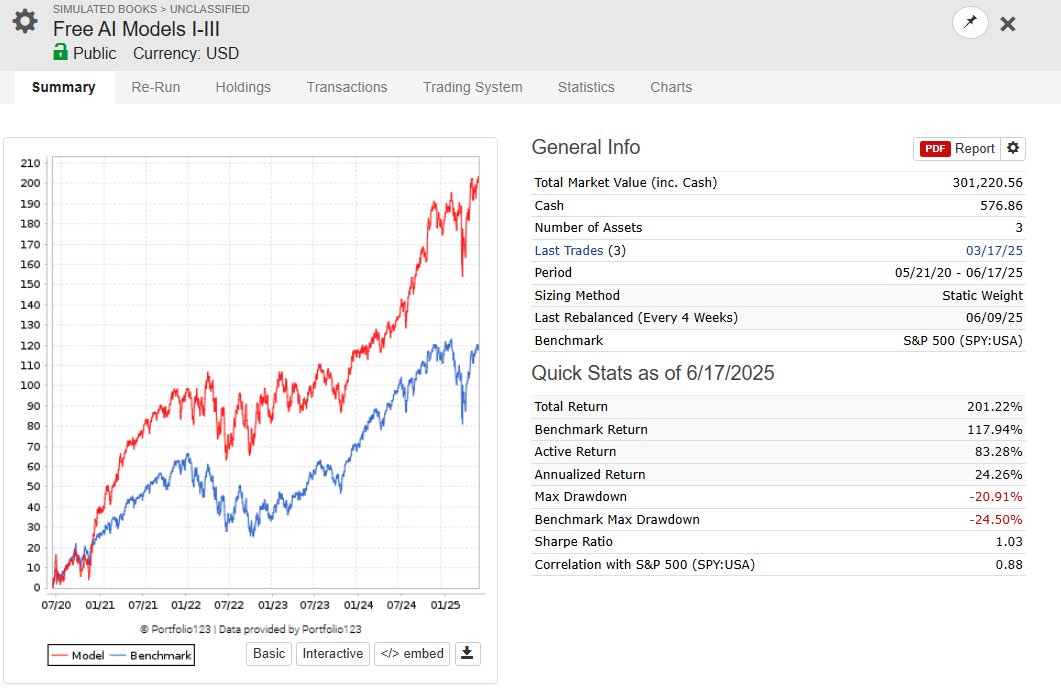

Finally: the link to the Strategy Book that combines all three AI Factor strategies (see screenshot below):

https://www.portfolio123.com/port_summary.jsp?portid=1861972

This is just a start!

Yes, I’ve added some buy rules (earnings estimates!) to the strategies — and you might argue that introduces hindsight bias. But I’ve been using these rules consistently since 2022 across a wide range of strategies, and they've delivered strong out-of-sample (OOS) performance.

There are also structural reasons behind their use: most notably, earnings estimates data has significantly improved in quality and timeliness.

Your next step: focus on refining your features — that’s where the real edge lies.

Best Regards

Andreas