Again, heads up to the P123 Research Group (paying subscribers to this blog get access, please use the same email address for this blog and your P123 account, I can then add you to the group manually, let me know if you are a member here, but I did not add you to the P123 group).

https://www.portfolio123.com/app/group/348/data/PTF

I get it, Backtests are backtests, Live OOS is Live OOS, therefore we post results in this blog.

Big Cap AI Factor 10 Stocks:

Big Cap AI Factor 20 Stocks:

AI Factor 200 Micro Caps:

If you are interested in private AI Factor Models curtailed to your liquidity needs, please contact https://x.com/Quant_Kurtis

Kurtis is a does marketing for P123 and is a full time Quant Consultant via P123.

This one is another one that we are watching (traditional build small cap factor systems have much higher DDs right now).

https://www.portfolio123.com/app/r2g/summary?id=1822627

In my private portfolio I got this one (hedged, I am net long 42% right now):

Not too easy to trade, the stock it picks up are scary (note to myself: and you better buy the ask if it breaks out on the day of the rebalance).

That one (below) comes freshly out of the production press (pretty much the same model as above, but ML Hyperparameters tuned via Deepseek).

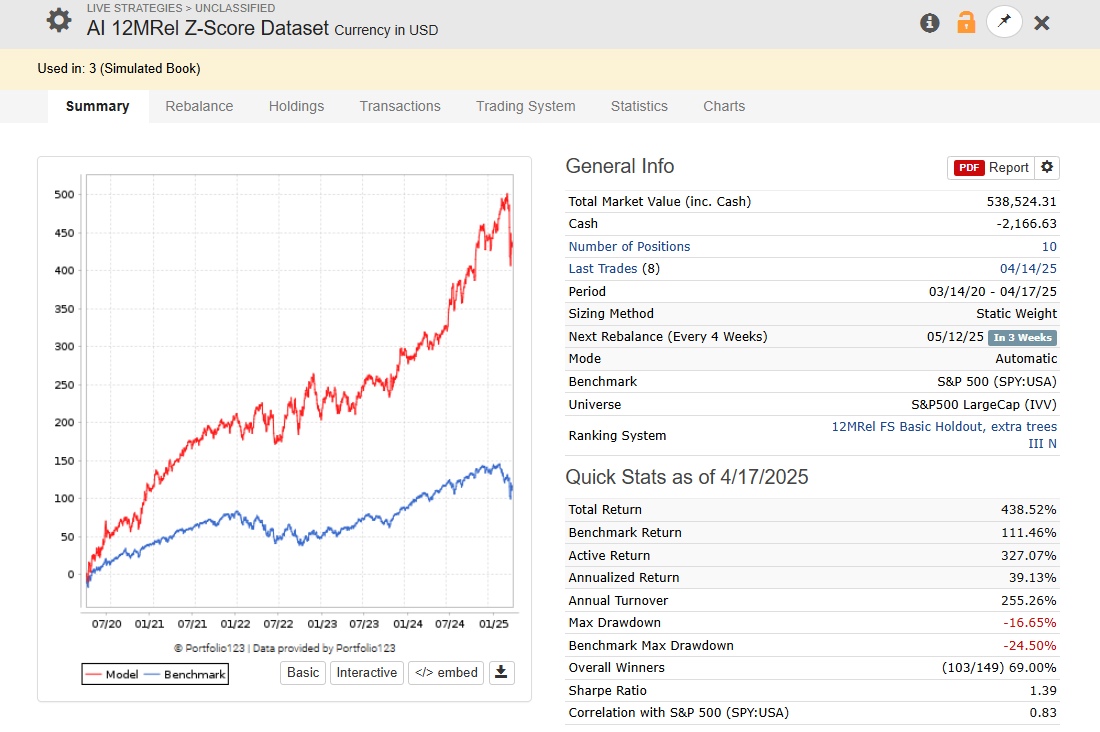

I get it, this looks too good to be true, but I checked everything at least 10 times, plus OOS live looks promising, so I switched all my private investing money to AI Factor models. Not saying this will work 100%, happy to fail, but what I see is simply to convincing.

So, let’s see :-)

My highest conviction idea for long-term conservative investors:

https://x.com/GfI_Himmelreich/status/1914262768594686437

https://www.portfolio123.com/port_summary.jsp?portid=1844277

Here is the rebalance from Rebalance 04/21/2025 —>

Keep reading with a 7-day free trial

Subscribe to Systematic AI Investing Portfolios to keep reading this post and get 7 days of free access to the full post archives.