Take the Cap Curve of this system books:

#SystemBook1

#SystemBook2

So, the most important part in swing trading - as I understand it - is the watchlist. The stocks in the watchlist need to have positive expectancy in the first place!

I would say both #Systems have positive expectancy ;-)

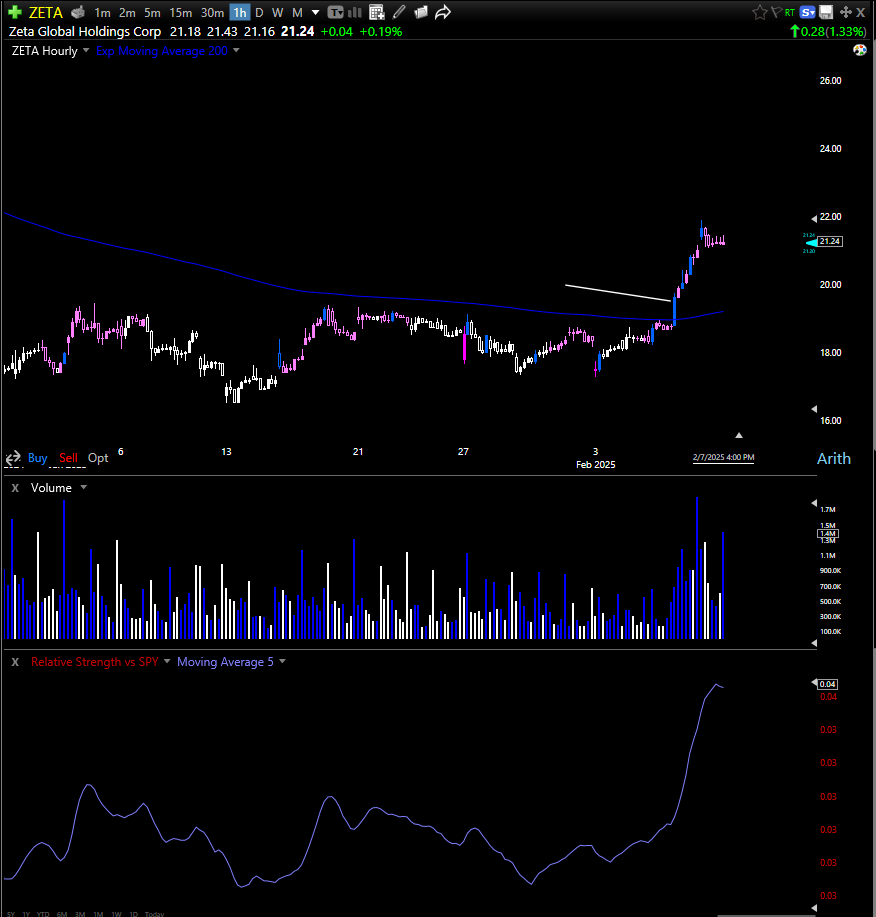

Pull up your favorite real time service (this is TC2000):

And put the stocks into a watchlist.

Take the hourly breakouts (blue bars) above (!) 200 MA (hourly), trailing stop loss is the 200 MA (hourly!):

Here is the chart template for TC2000 https://www.tc2000.com/~gLndRq

Especially #SystemBook1 stocks should do well, it got NVDA, APP etc.!

Why is that?

#SystemBook1 relies on the following ranking factors:

Accelerating earnings momentum based on earnings estimates with low standard deviation between the estimates of the single analysts. This is important, analysts must go in lockstep, then institutions start to watch. I put this factor (feature) in over 25 AI Models, it is always in the top 3 relating to feature importance, e.g. nonlinear ML Models rank it to the stars.

Accelerating earnings momentum based on actuals data, actuals data comes from press releases (only Portfolio123.com has them Point in Time wise, you can get them also from FactSet, but those numbers are not Point in Time!). It means management thinks the stock needs a push and revise up. They then talk to analysts, and they increase earnings estimates. I put this factor (feature) in over 25 AI Models, it is always in the top 5 relating to feature importance, e.g. nonlinear ML Models rank it to moon.

High Liquidity: it means that intuitions can trade those stocks, that means they track very well with an uptrending market. And it also means we can trade those stocks almost without slippage.

ChatGPT:

Here are the positions (I will update Monday before Market Open!):

Keep reading with a 7-day free trial

Subscribe to Systematic AI Investing Portfolios to keep reading this post and get 7 days of free access to the full post archives.